The battle over investment underscores a broader political dynamic at play, with both parties casting around for solutions to the high cost of housing.

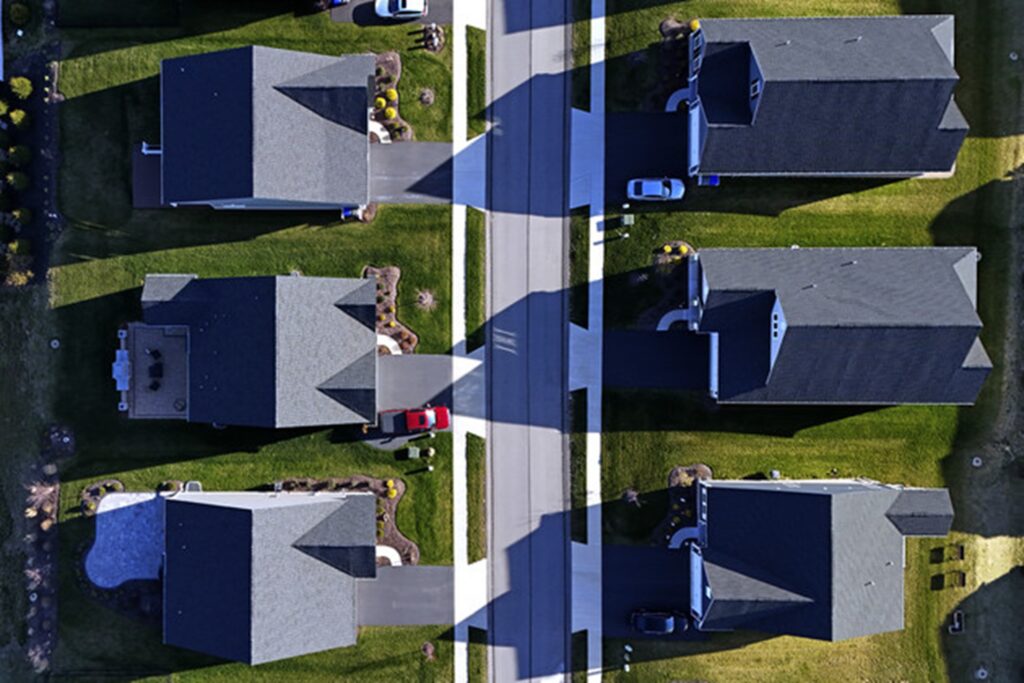

Members of both parties blame investors snapping up homes for driving up the cost of housing. | Gene J. Puskar/AP

Members of both parties blame investors snapping up homes for driving up the cost of housing. | Gene J. Puskar/AP

https://www.politico.com/news/2024/10/14/harris-vance-housing-crisis-00183484

Vice President Kamala Harris and Sen. JD Vance agree on at least one thing: Large corporate investors are fueling the nation’s housing affordability crisis and should be discouraged from snapping up homes.

It’s a rare instance of bipartisan consensus — but economists and housing analysts say they’re both wrong.

Investors have purchased up to 30 percent of available homes at different points over the last few years, mostly turning them into rental housing. Most of the buyers are smaller investors, but Harris, Vance and other critics including Sen. Sherrod Brown (D-Ohio) are focusing on larger entities — those such as private equity firms that buy 100 homes or more — arguing that they’re freezing homebuyers out of the market and jacking up rents.

Industry experts, however, say kicking investors out of the housing market is exactly the wrong approach. They say businesses are plowing much-needed money into the market, including in dilapidated homes that no one else will touch; that single-family home rentals serve a crucial purpose; and that build-to-rent developments are adding to inventory at a time when lack of supply is driving up prices.

“For some segments of both the left and the right politically, big faceless corporations buying up homes and driving people out of homeownership is a very nice scapegoat, which doesn’t get at the actual problem,” said Jenny Schuetz, a senior fellow at the Brookings Institution’s Metro program. “Nobody wants to run for office saying the reason young people can’t buy their first homes is old people are staying in them too long or paying all cash — that would be politically suicidal.”

The battle underscores a broader political dynamic at play, with both parties casting around for solutions to one of the top concerns of voters — the increasingly high cost of housing. Since most of the factors driving up prices, including restrictive zoning, are determined at the local level, there’s not a lot Washington can do. That’s led frustrated politicians to scramble for new ideas to tackle the problem around the edges, including selling off surplus federal land for the construction of affordable housing and establishing new grant programs to encourage localities to make it easier to build.

Now, Harris has called on Congress to pass legislation sponsored by Brown, who chairs the Senate Banking Committee, that would prohibit investors who own 50 or more single-family rental homes from deducting interest or depreciation on those properties. “Community after community feels taken advantage of by Wall Street investors and distant landlords,” her campaign said in its housing plan, and Harris pledged last month to “take on …corporate landlords who are hiking rental prices.”

Most of the buyers are smaller investors, but critics including Sen. Sherrod Brown are focusing on larger entities. | Francis Chung/POLITICO

Most of the buyers are smaller investors, but critics including Sen. Sherrod Brown are focusing on larger entities. | Francis Chung/POLITICO

Vance singled out investor ownership of single-family homes as a problem for middle-class Ohioans in his speech declaring his run for Senate three years ago, and he’s hammered the issue in interviews since then. Institutional investors “completely crowd out the availability for homes for people who want to just buy a piece of their community,” he said in a local news interview last year.

Rep. Ro Khanna (D-Calif.) has a similar bill in the House.

“Homes should be owned by people, not institutional investors who are drastically increasing the cost of rent and owning a home,” Khanna said in an email to POLITICO. “We need to address the housing shortage and build more, but giving handouts to Wall Street investors is not the solution.”

And Consumer Financial Protection Bureau Director Rohit Chopra joined the chorus Friday during a Salt Lake City event.

“The role of big investors and especially private equity firms in purchasing so much rental housing — there’s a lot of evidence that this is creating in some ways artificial scarcity and higher rents,” Chopra said.

Neither the Harris nor the Trump-Vance campaign responded to questions about their plans.

Large institutional investors with at least 1,000 properties owned about 3 percent of the 14 million single-family rental homes in the country as of 2022 —or nearly 450,000 homes, according to a Government Accountability Office report, with the five largest investors alone owning 2 percent.

Institutional investors started buying foreclosed homes in bulk in the wake of the 2008 financial crisis. As lending standards tightened following the meltdown, larger investors had funding advantages over smaller ones, while people with lower credit scores were forced to rent, increasing demand for single-family rentals.

Then investor purchases soared in the wake of the pandemic, as skyrocketing home values and low borrowing rates made single-family homes a desirable asset. Investors’ share of single-family home purchases rose to just under 30 percent in January of this year, according to CoreLogic, up from an average of 16 percent in the three years before the pandemic.

The role investors play in the market is complicated, said Jim Parrott, a nonresident fellow at the Urban Institute who was a senior White House economic adviser in the Obama administration.

“There’s nothing per se wrong with the model, especially because some of them are creating supply,” he said. “What’s problematic is they have tax incentives that make purchasing property in some sense easier to do than it is for individual homebuyers.”

A bill limiting depreciation write-offs for large investors in housing could free up additional revenue when Congress reopens the tax code next year to deal with expiring cuts from 2017, according to Jaret Seiberg, managing director at TD Cowen’s Washington Research Group.

“The need to enact a tax package in 2025 would give Vance a unique opportunity to deliver on his pledge to force institutional owners to sell these properties” if Donald Trump wins in November, Seiberg said in a client note. That could result in “as many as 570,000 additional single-family housing units hitting the market in 2026 or 2027.”

Yet devising rules to curb the practice would be difficult, said Schuetz.

“On a practical level, how the federal government could write regulations that limit purchases by a particular kind of corporate entity — I don’t know how you do that,” she said. It would be “really difficult to write regulations in a way that is transparent and can hold up to litigation.”

And there’s always the potential for unintended consequences as a result of cracking down: A tax on short-term speculation in Hong Kong decreased investors’ purchases of homes but also removed a source of liquidity in the market for homeowners who wanted to sell, according to a 2022 study.

Meanwhile, build-to-rent construction — where investors actually expand the supply of housing — grew from 5 percent of housing starts in 2021 to 10 percent in 2023, according to the National Association of Realtors, marking the largest number and share since NAR started collecting the data in 1974.

An aide to Brown said his bill would not apply to new construction, so it wouldn’t limit supply.

“What we’re doing is responding to the demand that’s out there that clearly is not being met, and we’re trying to fill a void — there just isn’t enough housing,” said David Howard, CEO of the National Rental Home Council, a trade group representing single-family rental owners.

Howard pointed out that 3 percent of single-family rentals works out to just 0.4 percent of the nation’s total housing — “so someone other than institutional investors account for 99.6 percent of the country’s housing.”

He added: “The average single-family home in this country is almost 40 years old and so you’ve got to invest in the current inventory, and that’s what providers, especially large providers, are doing when they’re investing in homes. Our large member companies invested $2 billion in things like renovations and upgrades and rehabilitations in 2023.”

Still, there are real concerns about large investors with a concentration of housing in a single area using their position to raise prices. These investors make up significant parts of the single-family rental market in cities across the Sunbelt, including Atlanta, Jacksonville and Charlotte.

“Requiring the big corporate entities to be more transparent about how many homes they own within a city or county, that seems to be useful,” Schuetz said. “But we just don’t have that information right now.”